Potential Trade War Fears offset by Strong GDP Outlook

- InfraCap Management

- Jan 19

- 2 min read

Updated: Jan 20

We are forecasting that US GDP growth accelerates from 2.7% in 2025 to 3.2% in 2026 as US growth returns to normal levels due to the dramatic reduction in mortgage rates that had caused a recession in the residential and construction industries. Many forecasters. such as the CBO which assumes a 1.8% long term growth rate, are consistently pessimistic about US economic growth, but the average post WWII US GDP growth rate is 3.15%. Consequently, our forecast of 3.2% is in line with historical rates.

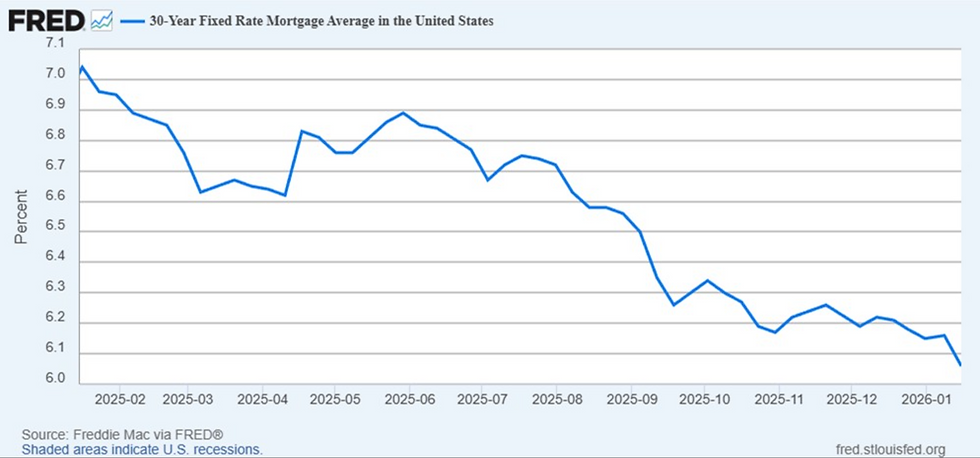

Our 3.2% growth forecast assumes continued strong personal consumption expenditures of 3% supported by tax refunds, stable employment prospects and declining inflation. We also forecast that investment spending rebounds to a 4% growth rate as residential investment and construction investment return to normal levels after a decline in 2025 (see chart of 30-year mortgage rates below). Finally, we expect government spending to rebound to a modest 2% growth rate as defense spending grows and Federal layoffs attenuate. The strong 3.2% GDP growth rate supports our aggressive S&P 500 Index target of 8,000, which assumes a 23x multiple of 2027 S&P EPS.

Stock prices are likely to be under pressure in the short run as the imposition of a 10% tariff on European countries related to the potential annexation of Greenland raises the possibility of a trade war. It is important to distinguish between modest tariffs on most imports in the 10-20% range that are similar to a federal import sales tax and potential trade wars with Europe or China that are likely to cause significant trade disruptions and distortions and could damage global economic growth. We view any related stock price declines as a potential buying opportunity as there is likely to be a diplomatic solution to the Greenland issue, possibly including a US military base on the island nation.

Comments