top of page

GLOBAL MONETARY BASE

Global Monetary Base Updates

Historical and Forecast Updates and Reports on the GMB

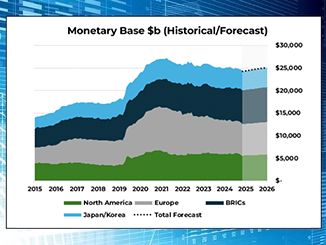

Global Monetary Base - Update through December 2025 and 2026 Forecast

The team at Infrastructure Capital Advisors tracks the Global Monetary Base, defined as currency in circulation plus bank reserves, as an indicator of current and future interest rates. This article provides data and insights through October 2025 with data released in November 2025.

InfraCap Management

Feb 11 min read

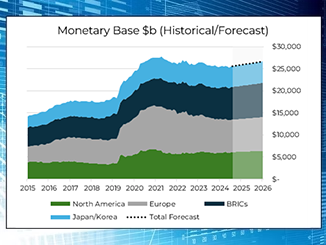

Global Monetary Base - Update through October 2025 and 2025 Forecast

The team at Infrastructure Capital Advisors tracks the Global Monetary Base, defined as currency in circulation plus bank reserves, as an indicator of current and future interest rates. This article provides data and insights through October 2025 with data released in November 2025.

InfraCap Management

Nov 12, 20251 min read

Global Monetary Base - Update through August 2025 and 2025 Forecast

he team at Infrastructure Capital Advisors tracks the Global Monetary Base, defined as currency in circulation plus bank reserves, as an indicator of current and future interest rates.

InfraCap Management

Sep 11, 20251 min read

Global Monetary Base - Update through June 2025 and 2025 Forecast

The team at Infrastructure Capital Advisors tracks the Global Monetary Base, defined as currency in circulation plus bank reserves, as an indicator of current and future interest rates. This article provides data and insights through June 2025 with data released in July 2025.

InfraCap Management

Jul 20, 20251 min read

Global Monetary Base - Update through March 2025 and 2025 Forecast

The team at Infrastructure Capital Advisors tracks the Global Monetary Base, defined as currency in circulation plus bank reserves, as an indicator of current and future interest rates. This article provides data and insights through March 2025 with data released in April 2025.

InfraCap Management

Apr 29, 20251 min read

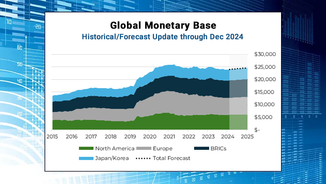

Global Monetary Base - Update through December 2024 and 2025 Forecast

The team at Infrastructure Capital Advisors tracks the Global Monetary Base, defined as currency in circulation plus bank reserves

InfraCap Management

Jan 17, 20251 min read

See Other Top InfraCapStories and Reports

February 2026 Commentary and Economic Outlook

Explore the February 2026 Economic Outlook featuring Economy, Stocks, Bond market analysis, and Commodity trends.

Continued American Exceptionalism Validated by Global Bond Spreads

The main implication of this tightening is not related to US exceptionalism but rather an indication that the rest of the world is way ahead of our incompetent Federal Reserve

Bullish Inflation Forecast Supports Our 8,000 S&P Target

We are very bullish about inflation declining to the arbitrary 2% target this year as the massively delayed shelter component of inflation finally reflects market rates and we roll off very high PCE prints in January and February of 2025. We forecast that PCE core inflation with roll down to 2.4% after the first quarter of 2026 and decline to 2% by the end of the year as shelter inflation rolls down throughout the year. Money supply growth is down over 6% year over year,

bottom of page